Anhydrous Hydrogen Fluoride Market: Global Size to Hit $5.3B by 2032

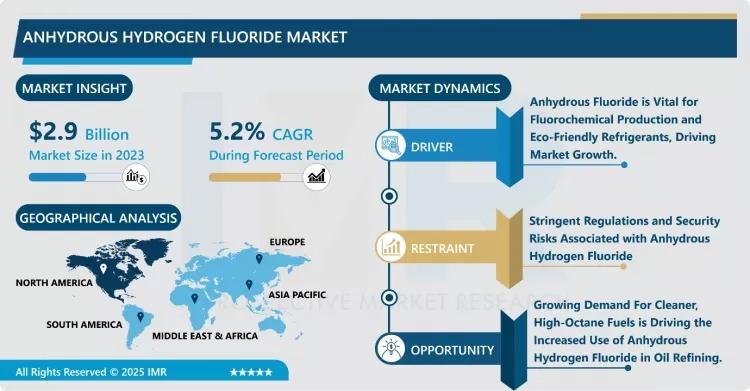

Introspective Market Research (IMR) today released its in-depth market report on Anhydrous Hydrogen Fluoride (AHF), projecting significant growth over the next decade. Based on our analysis, the AHF market is expected to grow from USD ~ 3.26 billion in 2024 to USD ~ 5.32 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.3% during the forecast period.

This expansion is being driven by increasing global demand for fluorochemicals, rising use of AHF in semiconductor and electronics manufacturing, and its crucial role in alkylation for high-octane fuels. Regulatory shifts favoring low-global-warming-potential (GWP) refrigerants are also boosting consumption.

Quick Insights

- 2024 Market Size: ~ USD 3.26 billion

- 2032 Forecast: ~ USD 5.32 billion

- CAGR (2024–2032): ~ 6.3%

- Primary Applications: Fluorogases, Fluoropolymers, Pesticides, Chemical Synthesis

- Leading Region: Asia-Pacific, due to robust chemical production and electronics manufacturing

- Key Players: Honeywell, Solvay, Linde, Arkema, Lanxess, Navin Fluorine, Foosung, Fluorsid, and others

- Emerging Trend: Use in alkylation in petroleum refining for cleaner, high-octane fuels

What’s Fueling the Growth?

- Surge in Fluorochemical Demand: AHF is a base building block for many fluorochemicals (e.g., fluoropolymers, refrigerants, agrochemicals), and expanding fluorochemical production is pushing demand.

- Alkylation in Petroleum Refining: AHF's role in alkylation — a refining process to produce high-octane gasoline — is growing, supported by rising fuel quality standards and demand.

- Electronics and Semiconductor Applications: The rise of semiconductors and specialty electronics requires high-purity HF, driving growth in higher-grade AHF.

- Regulatory and Environmental Trends: Stricter regulations on refrigerants and push toward low GWP gases are increasing demand for AHF in modern refrigeration and air-conditioning systems.

Where Are the Opportunities & Emerging Trends?

Could AHF's role in fuel refining reshape global hydrocarbon markets?

- Expanding alkylation capacity in refineries could significantly boost AHF volumes, especially in regions modernizing their fuel infrastructure.

- Partnerships between chemical companies and refineries may optimize AHF supply chains for both chemical and fuel production.

Is high-purity AHF the next frontier for electronics and specialty chemicals?

- With rising demand for semiconductors, there is a growing need for ultra-high-purity (>99.90%) AHF, opening a niche market.

- Emerging applications in solar cell etching, pharmaceuticals, and specialty intermediates could fuel growth of premium-grade AHF.

Will regional expansion shift the competitive landscape?

- Asia-Pacific is likely to continue leading, but Mid-East and Latin America could emerge as growth hubs, especially with investments in refining and specialty chemical capacity.

- Environmental and sustainability goals may drive the adoption of greener AHF production routes (e.g., from fluorosilicic acid).

Expert Voice

“Anhydrous hydrogen fluoride remains a linchpin in the fluorine chemical value chain,” said Dr. Neha Ranjan, Principal Consultant, Energy & Specialty Chemicals, at Introspective Market Research.

“Growth in high-purity electronics-grade AHF and its expanding role in fuel refining provide a compelling dual-growth engine. Companies that invest in both purity-driven R&D and regional production will be well positioned to lead over the next decade.”

Regional & Segment Outlook

- Asia-Pacific: Expected to maintain dominance, driven by strong presence of fluorochemical production and semiconductor manufacturing.

- North America: Growth supported by refinery capacity expansion and stringent fuel standards, fueling demand for AHF in alkylation.

- Europe: Likely to increase demand for high-purity AHF for specialty chemical markets.

By Purity Grade:

- < 99.90% AHF continues to dominate due to broad use in fluorochemical and refining applications.

- > 99.90% AHF (ultra-pure) is gaining ground for semiconductor and specialty uses.

By Application:

- Fluorogases represent the largest application segment, driven by refrigerant manufacturing.

- Fluoropolymers are projected to grow steadily, supported by electronics, automotive, and chemical intermediates.

Breakthroughs & Innovation Highlights

- Green Production Technologies: Companies are exploring converting fluorosilicic acid (a byproduct of the phosphate fertilizer industry) into AHF, offering a more sustainable and cost-effective route.

- Ultra-high-purity AHF: Leading manufacturers are investing in processes to produce >99.90% AHF to meet the increasing purity demand from electronics and specialty chemical sectors.

- Improved Safety & Handling: Innovations in storage, transport, and handling systems are reducing the risk associated with AHF’s corrosive nature — improving adoption in emerging markets.

Challenges & Cost Pressures

- Corrosiveness & Safety Risks: AHF is highly corrosive and hazardous, requiring stringent safety protocols, specialized equipment, and skilled workforce — increasing operating costs.

- Raw Material Dependence: Dependence on fluorspar (fluorite) for AHF production exposes the market to price volatility and supply chain risks.

- High CapEx: Establishing high-purity AHF production (especially for semiconductor-grade) requires significant capital investment in purification and containment systems.

- Regulatory Compliance: Strict environmental and health regulations around HF handling and transportation add to the compliance cost burden.

Case Study: Refinery-Chemical Integration for AHF Efficiency

A major refinery-chemical complex in Southeast Asia integrated its HF alkylation unit with a downstream fluorochemical plant to feed AHF internally. Key outcomes over 5 years:

- CapEx reduction by 15% due to shared infrastructure

- Logistics costs lowered by 20%, as AHF is not transported externally

- Supply reliability improved, reducing production downtime in both refinery and chemical operations

- Environmental risk minimized, as internal handling and containment were optimized and centralized

Call to Action

To access the full Anhydrous Hydrogen Fluoride Market Report, including regional forecasts, purity-grade analysis, and strategic recommendations:

- Download a Free Sample Report: anhydrous-hydrogen-fluoride-market /

- Schedule a Strategy Briefing: Contact our Principal Consultants at sales@introspectivemarketresearch.com or +91-74101-03736 / +91-95790-51919

About Introspective Market Research

Introspective Market Research (IMR) is a global market intelligence firm specializing in chemicals, energy, and industrial materials. With rigorous data methodology, expert analysts, and forward-looking scenarios, IMR helps companies identify growth levers and shape their strategic roadmaps.

Media Contact

Introspective Market Research

Phone: +91-74101-03736 | +91-95790-51919

Website: introspectivemarketresearch.com

- Anhydrous_Hydrogen_Fluoride_Market

- AHF_Market

- Fluorochemicals_Market

- Fluorogases_Market

- Fluoropolymers_Market

- Chemical_Intermediates

- Specialty_Chemicals

- Petrochemical_Industry

- Alkylation_Process

- High-Octane_Fuel_Additives

- Semiconductor_Chemicals

- Electronics-Grade_AHF

- Ultra-High-Purity_AHF

- Refrigerant_Manufacturing

- Low-GWP_Refrigerants

- Fluorosilicic_Acid_Conversion

- Fluorspar_Supply_Chain

- Chemical_Safety_Regulations

- Industrial_Gases_Market

- Introspective_Market_Research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness