Medium Entropy Alloys Market Size|(2024-2032)-IMR Study.

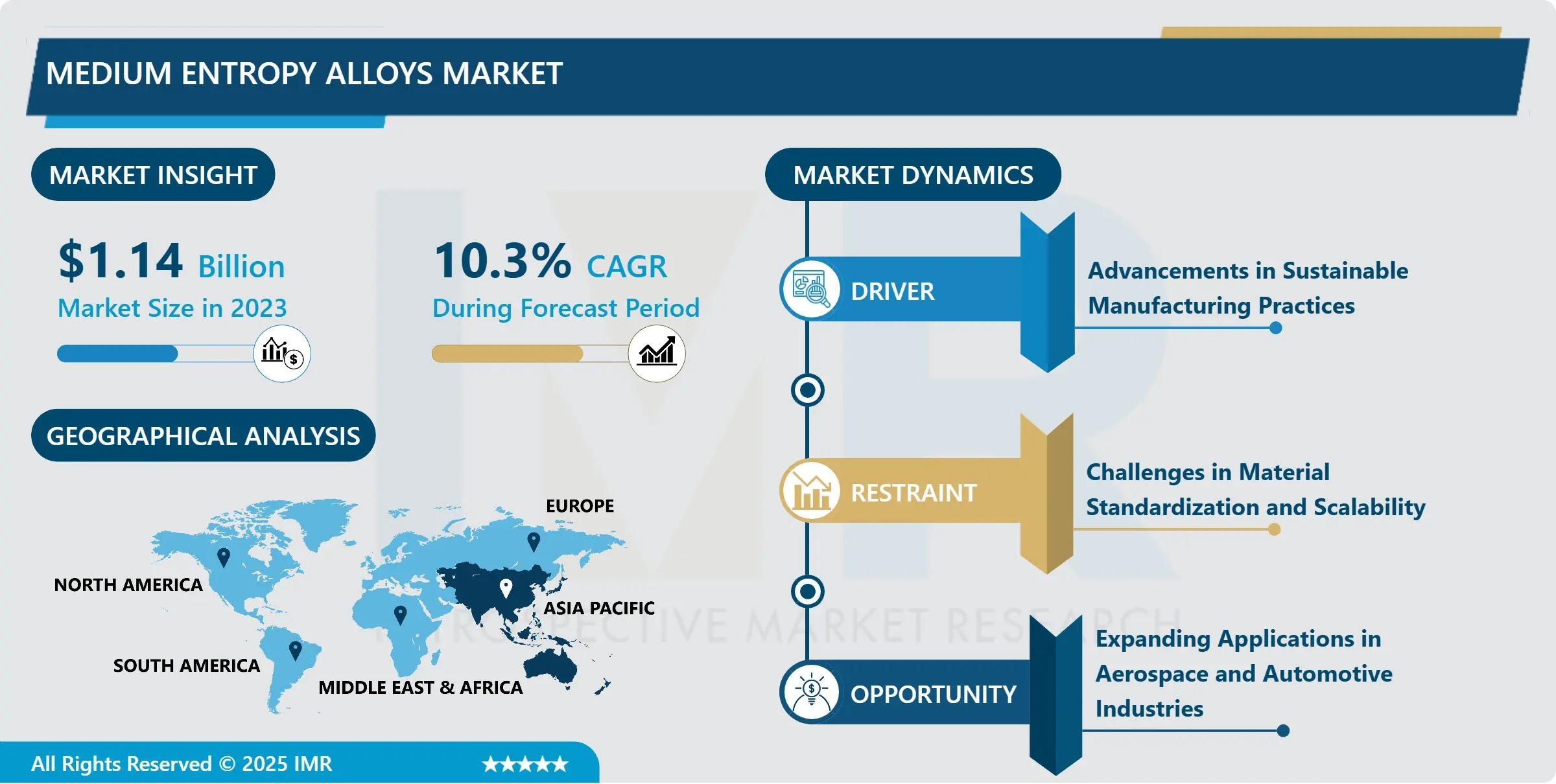

The Global Medium Entropy Alloys (MEAs) Market, valued at USD 1.14 billion in 2023, is projected to surge to USD 2.75 billion by 2032, advancing at a robust CAGR of 10.3% from 2024 to 2032, according to a new in-depth analysis by Introspective Market Research.

Unlike traditional binary or ternary alloys-and distinct from their higher-complexity cousins, High-Entropy Alloys (HEAs)-MEAs offer a “Goldilocks zone” of compositional complexity: typically 2 to 4 principal elements in near-equimolar ratios. This strategic balance delivers exceptional combinations of strength, ductility, thermal stability, oxidation resistance, and corrosion resilience-without the prohibitive processing costs or phase-instability risks often associated with HEAs.

Demand is being driven by intensifying pressure to decarbonize aerospace and automotive systems, rising deployment of MEAs in high-temperature turbine components, and the accelerating adoption of additive manufacturing (AM)-which unlocks geometric freedom for MEA-based lattice structures, conformal cooling channels, and topology-optimized parts previously unattainable via casting or forging.

Quick Insights: Medium Entropy Alloys Market at a Glance

- 2023 Market Size: USD 1.14 Billion

- 2032 Projected Value: USD 2.75 Billion

- CAGR (2024–2032): 10.3%

- Dominant Alloy Segment: Single-Phase Alloys (uniform microstructure, balanced mechanical/thermal performance)

- Leading Application Segment: Aerospace (41.2% share in 2023; structural brackets, turbine blades, fasteners)

- Fastest-Growing End-User Sector: Energy (especially concentrated solar power and next-gen nuclear components)

- Top Regional Market: Asia Pacific (34.6% share in 2023; led by China, Japan, and South Korea)

- Key Industry Players: ATI Inc. (USA), Carpenter Technology Corporation (USA), Haynes International, Inc. (USA), VDM Metals (Germany), Osaka Titanium Technologies Co., Ltd. (Japan), Samsung Advanced Institute of Technology (South Korea), Crucible Industries (USA), Eramet (France)

Why Are Medium Entropy Alloys Moving from Lab Curiosity to Industrial Mainstay-And What’s Holding Back Wider Adoption?

MEAs are no longer just academic novelties. Their unique microstructural stability-enabled by moderate configurational entropy and sluggish diffusion kinetics-allows them to retain strength at >800°C, resist sulfidation in aggressive environments, and suppress crack propagation under cyclic loading. For industries where failure is non-negotiable, MEAs are becoming the material of record.

Yet commercialization hurdles remain: raw material cost volatility (especially for Co, Nb, Mo), limited large-scale production infrastructure, and the absence of standardized certification protocols for AM-fabricated MEA components. The path forward hinges on compositional optimization, process innovation, and supply-chain resilience-not just performance alone.

“Medium Entropy Alloys represent the pragmatic evolution of entropy-stabilized metallurgy,” says Dr. Vikram Desai, Principal Consultant, Advanced Materials & Additive Manufacturing Practice at Introspective Market Research.

“Where HEAs pushed the boundaries of complexity, MEAs are delivering the right complexity—enough to outperform nickel superalloys in specific regimes, but not so much that fabrication becomes economically untenable. We’re now seeing OEMs co-develop MEA formulations with suppliers—tailoring Cr-Mn-Fe or Fe-Co-Ni systems for specific service conditions. The real inflection point will come when ASTM and ASME codify MEA-AM qualification standards—which our tracking shows could happen as early as 2027.”

Regional Analysis: Asia Pacific Leads, But North America Drives High-Value Innovation

Asia Pacific (34.6% Market Share)

APAC dominates due to massive investments in aerospace manufacturing (COMAC C919 supply chain in China), high-efficiency thermal power plants (India’s ultra-supercritical boiler program), and national AM roadmaps (Japan’s METI “Materials Integration” initiative, South Korea’s K-AM 2030 strategy). China alone accounts for 18% of global MEA consumption-primarily in defense and energy applications-while Japanese firms lead in Fe-based MEA development for cost-sensitive industrial use.

North America (28.4% Share)

The U.S. remains the innovation engine: NASA’s collaboration with Carpenter Tech on CrMnFeNi-based MEA turbine shrouds, GE Aerospace’s evaluation of MEA lattice structures for combustor liners, and DoD-funded projects exploring MEAs for hypersonic vehicle leading edges. Crucible Industries’ recently commissioned vacuum induction melting (VIM)-VAR line in Solon, Ohio—dedicated to MEA billet production-signals growing commercial confidence.

Europe (22.1% Share)

Germany and France anchor high-value adoption: Siemens Energy is piloting MEA-coated heat exchanger tubes in hydrogen-ready gas turbines, while Safran is qualifying MEA fasteners for A320neo wing assemblies. Regulatory tailwinds-including inclusion in the EU’s Critical Raw Materials Act (CRMA) substitution list-are accelerating R&D partnerships across the DACH region.

Segmentation Deep Dive: Where the Performance Premium Pays Off

By Alloy Type

|

Segment

|

Characteristics

|

Primary Applications

|

Growth Catalyst

|

|---|---|---|---|

|

Single-Phase Alloys

|

FCC/BCC-dominant, homogeneous structure; excellent ductility & weldability

|

Aerospace structural parts, automotive exhaust components

|

Preferred for AM due to low cracking susceptibility; ~62% market share in 2023

|

|

Multi-Phase Alloys

|

Dual/multi-phase (e.g., FCC+L1₂, BCC+B2); higher strength & wear resistance

|

Turbine blades, downhole drilling tools, armor plating

|

Gaining traction in defense & oil/gas; projected CAGR of 11.8% (2024–2032)

|

By Application (2023 Share & Outlook)

- Aerospace (41.2%): Lightweighting without sacrificing creep resistance-e.g., MEA brackets replace Ti-6Al-4V at 20% weight reduction.

- Energy (23.7%): Supercritical steam turbines (700°C+), CSP receiver tubes, molten-salt corrosion barriers.

- Automotive (16.5%): Turbocharger housings, exhaust manifolds, EV battery thermal interface components.

- Defense (10.3%): Armor-piercing penetrators, vehicle underbody protection, UAV propulsion systems.

- Electronics (5.1%): High-conductivity, low-CTE heat spreaders for GaN/SiC power modules.

- Others (3.2%): Biomedical implants (Co-free MEAs), tooling dies, marine propulsion shafts.

Innovation & Cost-Efficiency: How Industry Leaders Are Scaling MEAs Responsibly

- ATI Inc. (USA) – Launched ATI 425®-ME, a Fe-Ni-Co-Cr-Mo single-phase alloy in Q1 2025 optimized for laser powder bed fusion (LPBF). Achieves >98% density with minimal hot cracking-and 30% faster build rates vs. legacy superalloys. Now qualified for non-rotating aerospace hardware.

- Samsung Advanced Institute of Technology – Developed a nanotwinned CoCrFeNi MEA exhibiting yield strength of 1.4 GPa at room temperature and retained ductility (>18% elongation) after 1,000h at 750°C-published in Nature Materials, October 2025. Targeting satellite propulsion nozzles.

- Osaka Titanium Technologies – Pioneered low-cost Fe-Mn-Al-C MEAs using recycled stainless scrap as feedstock—cutting raw material costs by 35% while maintaining oxidation resistance up to 650°C. Commercial trials underway with Japanese boiler OEMs.

- VDM Metals (Germany) – Introduced VDM® MEA 800, a creep-resistant variant tailored for hydrogen-combustion turbine environments-resisting H₂ embrittlement and steam oxidation simultaneously.

Strategies to Improve Cost Efficiency

- Feedstock Recycling: Recovery of unused AM powder via inert-atmosphere sieving and re-blending (up to 4 cycles without degradation).

- Hybrid Manufacturing: Combining LPBF near-net-shape builds with CNC finishing-reducing support structures and material waste by ~40%.

- Composition Simplification: Replacing Co with Fe/Mn in non-critical aerospace parts (e.g., brackets, ducts)-without sacrificing thermal fatigue life.

- Digital Twins for Process Control: AI-driven melt-pool monitoring reduces scrap rates by 12–18% in serial MEA production.

Cross-Industry Benefits of MEA Adoption

- For OEMs: Extended component life (2–3× in thermal cycling), reduced maintenance downtime, higher operational temperatures → improved system efficiency.

- For AM Service Bureaus: Premium pricing for certified MEA builds (30–50% margin uplift vs. Ti/Al parts).

- For Energy Operators: Lower LCOE (Levelized Cost of Energy) via higher turbine inlet temperatures and longer inspection intervals.

- For Regulators: Pathway to meet EU Green Deal durability mandates and U.S. DOE 2030 efficiency targets.

Access the Complete Strategic Intelligence Package

The Medium Entropy Alloys Market Report (2024–2032) by Introspective Market Research delivers 240+ pages of granular, decision-ready analysis:

- 20+ proprietary alloy system profiles (compositions, properties, IP landscape)

- Application-specific performance benchmarks vs. Ni-superalloys, Ti, and HEAs

- AM processability matrix (LPBF, EBM, DED compatibility by alloy type)

- Regional supply chain mapping: raw material sourcing, melting capacity, certification bottlenecks

- 15+ company profiles with R&D pipelines, M&A activity, sustainability KPIs

- Regulatory watch: FAA/EASA airworthiness pathways, ASME BPVC Section II updates, REACH implications

Download a Free Sample Report:

https://introspectivemarketresearch.com/request/20202

About Introspective Market Research

Introspective Market Research(IMR) is a globally recognized leader in strategic intelligence for advanced materials, additive manufacturing, and deep-tech industrial sectors. Our team of materials scientists, process engineers, and commercial analysts combines primary interviews with 300+ OEMs, foundries, and research labs-with patent mining, supply chain forensics, and real-world failure analysis-to deliver foresight that informs billion-dollar R&D and sourcing decisions.

We turn materials complexity into competitive advantage.

Media Contact

Rahul Khanna

Senior Director, Advanced Materials Communications

Introspective Market Research

info@introspectivemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness