Contactless Payment Market Analysis – Size, Trends & Strategic Outlook to 2035

"Executive Summary Contactless Payment Market Opportunities by Size and Share

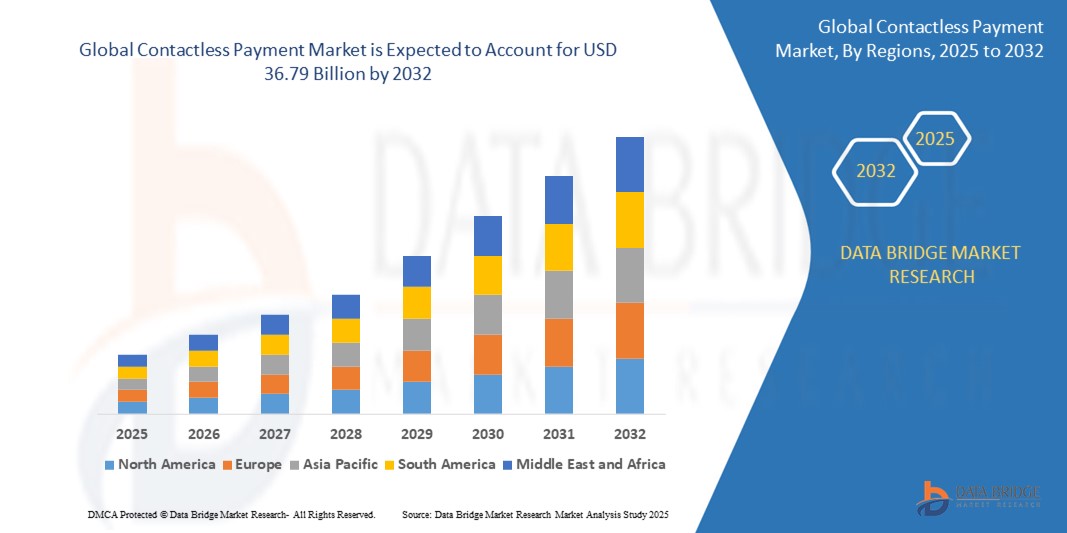

The global contactless payment market was valued at USD 15.74 billion in 2024 and is expected to reach USD 36.79 billion by 2032.During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.20%, primarily driven by technology innovation

To achieve detailed market insights and keep market place clearly into the focus, such wide-ranging Contactless Payment Market research report has to be there in the picture. Each of these chapters is researched and analysed in detail for formulating a comprehensive market research report. In addition, competitor analysis is performed very well in the first class Contactless Payment Market report which takes into account vital aspects about the key players in the market such as strong and weak points of the competitors and analysis of their strategies with respect to product and market.

A team of innovative analysts, passionate forecasters, knowledgeable researchers and experienced industry experts work keenly and 24*7 to produce the most excellent Contactless Payment Market report. It is an essential document for every market enthusiast, policymaker, investor, and market player. This market report endows clients with the information on their business scenario with which they can build business strategies to thrive in the market. Confidently trust on the information offered in this market research report as it is derived only from the valuable and genuine resources. The persuasive Contactless Payment Market report is provided with full commitment by assuring the best possible service depending upon business requirements.

Analyze top trends and market forces impacting the Contactless Payment Market. Full report ready for download:

https://www.databridgemarketresearch.com/reports/global-contactless-payment-market

Current Scenario of the Contactless Payment Market

**Segments**

- By Device Type: Contactless Card (Smart Cards, Smartphones), Contactless Reader (Point-of-Sales Terminals, Automatic Fare Collection, ATMs)

- By Technology: Radio Frequency Identification (RFID), Near Field Communication (NFC)

- By Payment Mode: Mobile Handsets, Wearable Devices

- By Application: Retail, Healthcare, Hospitality, Transportation, BFSI

Contactless payment has seen a surge in adoption globally due to its convenience and contactless nature, which has become even more crucial in the wake of the COVID-19 pandemic. The market segmentation based on device type includes contactless cards such as smart cards and smartphones, as well as contactless readers like point-of-sales terminals, automatic fare collection systems, and ATMs. In terms of technology, the market is categorized into RFID and NFC technologies. RFID allows for contactless communication through radio frequencies, while NFC enables devices to communicate within a short range wirelessly. The payment mode segment comprises mobile handsets and wearable devices that support contactless transactions. Applications of contactless payment span across various sectors such as retail, healthcare, hospitality, transportation, and the BFSI industry, showcasing its versatility and widespread usage across different domains.

**Market Players**

- Visa Inc.

- Mastercard

- American Express

- PayPal Holdings, Inc.

- Wirecard

- Gemalto NV

- Verifone

- Heartland Payment Systems

- Giesecke+Devrient

- Ingenico Group

The global contactless payment market is highly competitive with several key players striving to gain a significant market share. Companies like Visa Inc., Mastercard, American Express, and PayPal Holdings, Inc. are prominent players in the market, leveraging their extensive networks and innovative technologies to drive the adoption of contactless payment solutions. Other notable players include Wirecard, Gemalto NV, Verifone, Heartland Payment Systems, Giesecke+Devrient, and Ingenico Group, each contributing to the expansion and advancement of contactless payment ecosystems worldwide. These market players are continuously introducing new products, forming strategic partnerships, and investing in research and development to stay ahead in the fast-evolving contactless payment landscape.

The global contactless payment market is experiencing a substantial growth trajectory driven by the increasing demand for secure, convenient, and hygienic payment methods. As contactless technology continues to permeate various industries, new opportunities for innovation and market expansion emerge. One key trend shaping the market is the integration of contactless payment solutions into everyday devices such as smartphones, wearables, and even IoT devices, enabling seamless transactions in diverse settings. This trend not only enhances user experience but also propels the market towards a more interconnected and digitally-driven future.

Moreover, the adoption of contactless payment systems in emerging economies presents a significant growth avenue for market players. Developing countries are witnessing a rapid shift towards digital payments, driven by factors such as urbanization, rising smartphone penetration, and government initiatives to promote cashless transactions. As a result, market leaders are investing in expanding their presence in these regions through strategic partnerships, localized offerings, and tailored marketing strategies to capitalize on the increasing demand for contactless payment solutions.

Moreover, the adoption of contactless payment systems in emerging economies presents a significant growth avenue for market players. Developing countries are witnessing a rapid shift towards digital payments, driven by factors such as urbanization, rising smartphone penetration, and government initiatives to promote cashless transactions. As a result, market leaders are investing in expanding their presence in these regions through strategic partnerships, localized offerings, and tailored marketing strategies to capitalize on the increasing demand for contactless payment solutions.

Furthermore, the convergence of contactless payment technology with other emerging technologies such as artificial intelligence, blockchain, and biometrics is reshaping the landscape of digital payments. These technologies enhance security measures, streamline transaction processes, and offer personalized payment experiences to users, thereby driving the adoption of contactless payment solutions across various sectors. Additionally, the ongoing advancements in contactless reader devices, backend payment infrastructure, and data analytics capabilities are enhancing the overall efficiency and reliability of contactless payment systems, further fueling market growth.

In terms of market dynamics, regulatory frameworks and industry standards play a crucial role in shaping the competitive landscape of the contactless payment market. Compliance with data protection regulations, interoperability requirements, and security standards are imperative for market players to gain consumer trust and maintain market credibility. As the market continues to evolve, collaborations between industry stakeholders, regulatory bodies, and technology providers will be essential to address emerging challenges, foster innovation, and ensure the seamless integration of contactless payment solutions into the global payment ecosystem.

Overall, the global contactless payment market is poised for significant growth driven by consumer preferences for digital transactions, technological advancements, and the widespread adoption of contactless payment solutions across industries. Market players need to be agile, innovative, and customer-centric to capitalize on emerging opportunities, navigate evolving regulatory landscapes, and differentiate their offerings in a competitive market environment. The future of contactless payments is marked by convenience, security, and efficiency, paving the way for a more interconnected and cashless society.The global contactless payment market is anticipated to witness substantial growth in the coming years, driven by the increasing demand for secure, convenient, and hygienic payment methods. Contactless technology has gained significant traction, especially in the wake of the COVID-19 pandemic, as consumers prioritize touchless interactions to minimize physical contact. This shift in consumer behavior has accelerated the adoption of contactless payment solutions across various sectors, including retail, healthcare, hospitality, transportation, and BFSI.

Market players such as Visa Inc., Mastercard, American Express, and PayPal Holdings, Inc. dominate the competitive landscape, leveraging their robust networks and technological capabilities to drive innovation in the contactless payment space. These key players are focused on introducing new products, forging strategic partnerships, and investing in research and development to stay competitive and cater to evolving consumer preferences.

The integration of contactless payment solutions into everyday devices like smartphones and wearables is a key trend shaping the market. This integration not only enhances user experience but also expands the reach of contactless payments to a wider audience, driving market penetration. Additionally, the convergence of contactless payment technology with emerging technologies such as AI, blockchain, and biometrics is further enhancing the security and efficiency of contactless transactions, making them more appealing to consumers and businesses alike.

The adoption of contactless payment systems in emerging economies presents a significant growth opportunity for market players. Developing countries are witnessing a rapid shift towards digital payments, driven by factors like urbanization, smartphone penetration, and government initiatives promoting cashless transactions. Market leaders are actively expanding their presence in these regions through localized offerings and strategic partnerships to capitalize on the growing demand for contactless payment solutions.

Regulatory frameworks and industry standards also play a crucial role in shaping the competitive landscape of the contactless payment market. Compliance with data protection regulations, interoperability requirements, and security standards are essential factors for market players to build trust among consumers and ensure the smooth functioning of contactless payment ecosystems. Collaborations between industry stakeholders, regulatory bodies, and technology providers will be key to addressing emerging challenges and fostering innovation in the contactless payment space.

In conclusion, the global contactless payment market is set to witness robust growth driven by technological advancements, changing consumer preferences, and the increasing adoption of contactless payment solutions across industries. Market players need to remain agile, innovative, and customer-centric to seize emerging opportunities, navigate regulatory complexities, and stand out in a highly competitive market landscape. The future of contactless payments holds promises of enhanced convenience, security, and efficiency, paving the way for a more seamless and connected digital payment ecosystem.

Access segment-wise market share of the company

https://www.databridgemarketresearch.com/reports/global-contactless-payment-market/companies

Targeted Question Batches for Contactless Payment Market Exploration

- What is the total global market volume of the Contactless Payment Market?

- How is the market expected to grow over the next five years?

- What categories hold the highest Contactless Payment Market value?

- Who are the leading innovators in this space?

- What new offerings are gaining Contactless Payment Market share?

- Which global areas are under analysis in the Contactless Payment Market report?

- What is the fastest-growing country within each region?

- Which countries are scaling production capacities?

- What zones are seen as future growth hubs?

- What trends are disrupting conventional business models?

Browse More Reports:

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness